Why should you do a cashflow forecast?

HOME / / Why should you do a cashflow forecast?

If paperwork makes your skin crawl, financial forecasting might be the kind of job you're a master at procrastinating over.

Bear with us, and we’ll make completing your cashflow forecast more bearable (and explain why it really is worth doing).

Going through the process of financial forecasting, including cashflow forecasting, can actually be very rewarding. Why? Because you’ll get a clear picture of your company’s future and be able to make business decisions with a lot more confidence.

The process involves using the past and current performance of your business to estimate the revenue, profits, cash and expenses you’re likely to see in the future. And that can be very exciting!

If you’ve little or no experience, we understand that business admin can be daunting. Especially if you’re a hands-on type of person, like Aaron.

That’s why Team Transmit are available to guide you through your forecast documents as part of your Start Up Loan application.

I'm not great on applications or academic stuff. I'm a physical guy. I live in the physical.

"I can't take any credit for us having a successful application, all of that was down to my amazing business partner. After we applied, we couldn't have had better support from Transmit. We'd rate the experience really well."

READ AARON'S STORYWhether you’re hoping to borrow £500 or £25,000 through a Start Up Loan, or you’re looking at other ways to fund your business, no one (except maybe your favourite Great Aunt?!) is going to hand over a chunk of cash without seeing your Business Plan and a Financial Forecast.

These documents are also crucial if you’re planning to pitch your business to Angel Investors.

Is a cashflow forecast actually essential though?

Rather than simply saying “hell, yeah!” let’s hear from the experts why predicting and tracking your cashflow will help make your business more resilient:

“You’ll know that the business is earning more money than it’s spending when you see a positive cash flow. Generally, this should mean that you’ll have cash on hand to cover your expenses such as payroll, equipment purchases, upgrades, loan repayments, etc.

However, if you find yourself having a negative cash flow, you may not be able to pay your employees and suppliers, cover rent or have the money needed for daily business costs.

This is where monitoring your cash flow regularly is crucial because it can give you valuable insights into how you can better prepare your company for growth in the future while helping you identify potential downfalls, shortfalls, and setbacks.”

OK, but how can I do a cashflow forecast if I’m not trading yet?

If your business is brand new and you’ve not yet made your first sale, the idea of predicting your cashflow in 3, 6 or 12 months’ time can seem impossible.

Whilst we don’t (yet) have a cashflow crystal ball to lend you, we do know from experience a method that works...

1. Download and complete your personal survival budget first.

This will help you look at all your personal expenses (also known as your cost of living) in order to calculate how much money you need each month to maintain your current lifestyle.

Your home and utilities, food, clothing, transport and childcare will be absolute essentials. But you should also include things like your TV streaming subscriptions and social activities, to get a full picture of how much you’re spending every month.

If you have multiple personal bank accounts, remember to check your regular outgoings from all of them! And if you don’t yet have a separate business bank account, we recommend Tide.

2. Find your breakeven point.

“Breaking even” is a term used to describe the tipping point when the money you’ve made by selling your products or services pays you back for everything you’ve spent on your business so far.

Let's look at an example of a trade business to see how you'd work this out.

Liam is a carpenter. In his first 3 months since startup up, he’s incurred the following expenses:

Website build and hosting £200

Purchase of new tools £550

Small business insurance cover £60 (£20 per month)

£150 Facebook advertising

£180 fuel for his van

Liam charges his customers a day rate of £300, and bills them for materials on top. To find his breakeven point, all needs to do is:

Add up all the expenses = £1,140

Work out how many days’ work he needs to pay himself back for what he’s invested so far = 4 days’ work

Because Liam will have to start paying tax as soon as he makes a profit, his calculations will need to include an estimate of Income Tax and National Insurance contributions for any money he makes over and above the breakeven point.

3. Now for the fun part!

Once you’ve calculated the sales you NEED to break even, you can then start to set yourself targets according to how much you WANT to sell, factoring how much you think your customers will want to buy and the price they’ll be willing to pay. Remember to consider seasonal variations.

If you’re starting your business as a side-hustle to top up your income, your sales targets might be fairly low to begin with, and that’s absolutely fine.

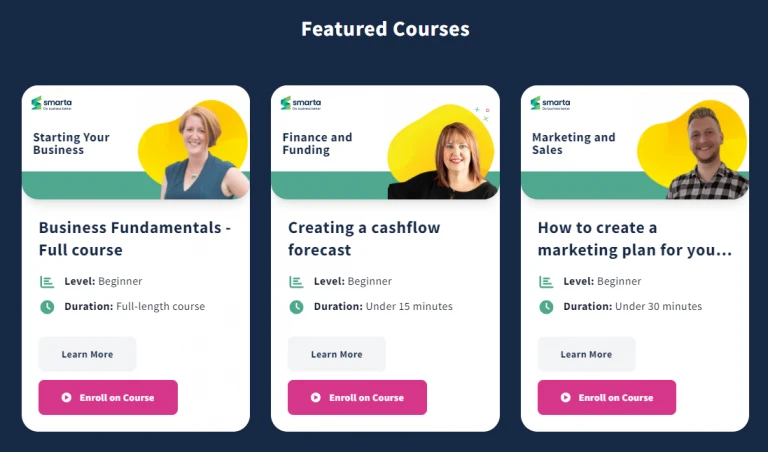

Once you’ve established your brand and feel ready to grow, you could benefit from taking some short, online business education courses from Smarta.

There are a huge range of topics to choose from, and they’re all available in bite-size lessons to fit into your busy schedule.

Is it better to do a cashflow forecast manually, or use an accounting app?

This can depend on how digitally-minded you are. Some entrepreneurs like to have an app for everything, but that doesn’t mean you have to. Provided you have access to a computer with Microsoft Excel, you can use our free template to complete your financial forecasts.

If you prefer to use forecasting software as an alternative to spreadsheets, this article by our accounting partners, Crunch, gives three examples of digital tools they’ve reviewed: Brixx, LivePlan and Pulse.

Is a cashflow forecast different to a sales forecast?

Yes - a cashflow forecast includes the expenses your business will incur (money going out), whereas a sales forecast only looks at the money coming into your business.

In this article we’ve focused mainly on Cashflow Forecasting. You can read about Top-down forecasting, Bottom-up forecasting and Hybrid forecasting here.

"We’re delighted to be the 2000th loan recipients!"